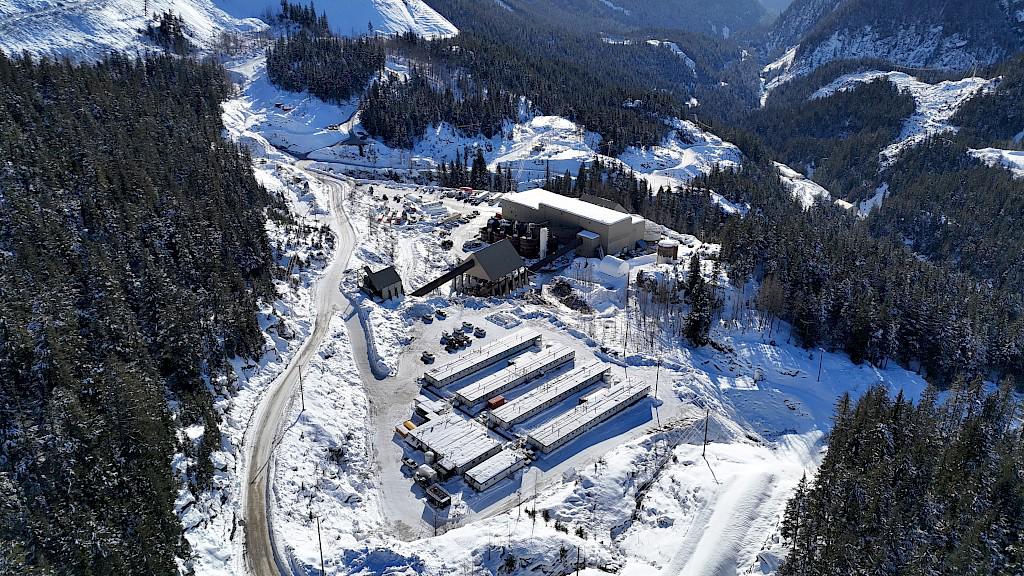

Côté Gold has an 18-year life of mine, which could be extended due to an undeveloped nearby deposit. Courtesy of Iamgold.

Iamgold announced on Sunday that is had poured the first gold at its open-pit Côté Gold mine near Gogama in northeastern Ontario.

“This achievement represents the culmination of over 15 million hours of work over four years of construction,” said Renaud Adams, president and chief executive officer of Iamgold, in a March 31 press release. “An incredible effort for the team on the ground as the project cost to first gold remains in line with the updated budget estimate while maintaining a near impeccable safety record.”

The company is now focused on ramping up to commercial production, which is expected in the third quarter of this year with a targeted 90 per cent throughput rate by the end of 2024.

Côté Gold is expected to produce between 220,000 to 290,000 ounces of gold this year, at cash costs of between US$700 to US$800 per ounce, provided the operation meets its remaining milestones.

The company stated that commissioning activities are progressing, with crushing, high-pressure grinding rolls and processing circuits meeting performance expectations. In mid-February, the company reported in its 2023 year-end results that total project costs to get to this first gold pour were in line with its final revised budget of US$2.965 billion. An additional US$40 million of operating expenditures, which include milling and surface costs, will be used in the commissioning and ramp-up phase.

The property consists of the Côté Gold deposit and the adjacent, undeveloped Gosselin deposit, and has a Mineral Resource estimate of 4.4 million indicated gold ounces from 161.3 million tonnes of ore at a grade of 0.85 grams per tonne.

According to Iamgold, production from the Côté Gold mine is forecast to average 495,000 ounces during the first six years of operations, and then to average 365,000 ounces per year over the rest of its 18-year mine life, which the company said will make it a contender for the third largest operating gold mine in Canada. The company added there is potential to extend the mine life due to the undeveloped Gosselin deposit.

The project is owned and operated by Iamgold, which holds a 70 per cent stake, while Sumitomo Metals Mining holds the remaining 30 per cent stake.