Rio Tinto’s Oyu Tolgoi project is just one example of mines being affected by the recent surge. Courtesy of Rio Tinto.

A surge this month in the price of copper—as high as US$9,146.50 per tonne on the London Metal Exchange—has given a boost to copper miners. While there are several forces that are responsible for this recent increase, one key factor involves Chinese copper smelters, which have been struggling to turn a profit. Let’s break down what has been causing this, what it could mean for the market and copper miners, and the outlook for this highly sought-after metal.

Why is this price surge happening now?

There are several factors at play. The most recent catalyst that is contributing to this surge is the response to the possibility that Chinese copper smelters could cut production. China, one of the largest refined copper producers and consumers across the globe, has recently experienced declining fees related to the smelting of copper. These fees are typically covered by mining companies to have their raw materials processed into metals. The drop is due to a combination of a shortage in concentrate to process and an expansion of processing capacity; more smelters are competing for a smaller supply and that is forcing them to lower their prices.

According to Bloomberg, the volume of copper concentrate being traded on the spot market has dropped more than 90 per cent over the last six months.

A crisis meeting was held on March 13 by some of China’s largest copper smelters to explore measures to combat this recent dive in ore processing fees that has sapped their profits. While the group did not commit to production cuts, the smelters agreed to re-arrange maintenance work, reduce runs and defer the startup of any new planned projects.

A number of smelting companies, including Jiangxi Copper Co. and Tongling Nonferrous Metals Group Co., are expected to convene next week for a quarterly meeting, where the smelters may discuss production plans.

What other factors are impacting this surge?

While the possible cuts to production at China’s smelters has played a significant role in the most recent global copper price surge, several other variables are at work, including the tightening of supply. Closures of copper mines, such as First Quantum’s Cobre Panamá mine back in November 2023, have contributed to this slump in supply. The mine, which was forced to close by Panama’s government in response to public pressure, was responsible for around one per cent of global copper concentrate production. Peru also saw an overall drop in production from its copper miners in January.

This comes at a time when copper, which is a key metal for electrification, is expected to be in high demand over the next few years, leaving many industry professionals worried about an enduring shortage of the metal.

What does this surge mean for the mining industry?

The setbacks suffered by copper smelters in China has been a boon for the market value of copper miners, which saw their share prices rise last week. High interest rates and other costs have made miners reluctant to make major investments in new projects despite the apparent consensus that demand for the metal will remain strong.

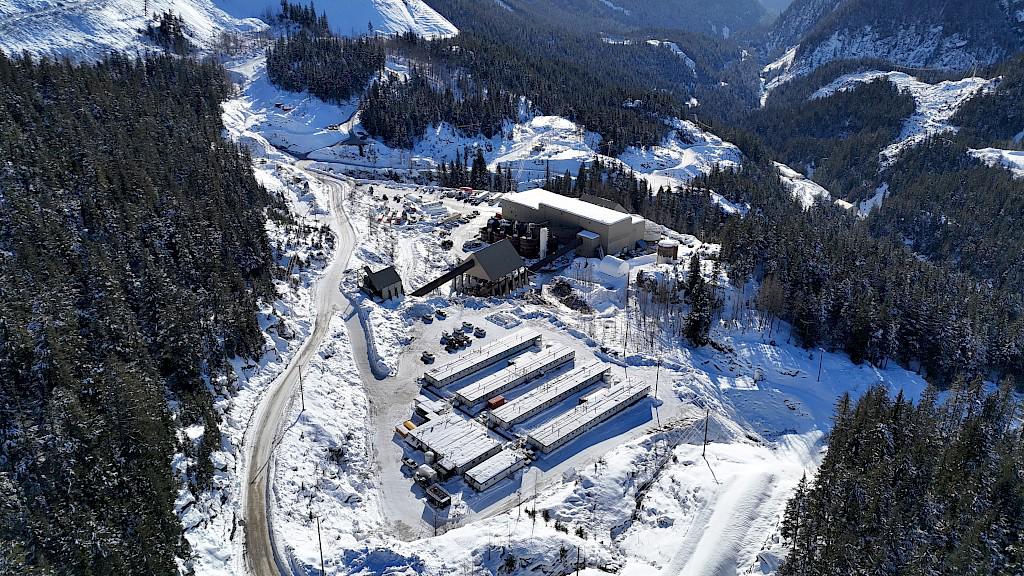

For example, Teck Resources revealed in October 2023 that the capital costs for its Quebrada Blanca 2 project in Chile, which is on a short list of new copper mines coming into production, went over budget again by more than half a billion U.S. dollars compared to its previous cost estimate. Similarly, Rio Tinto’s massive Oyu Tolgoi operation in Mongolia has had its own struggles controlling costs.

This price surge should give some relief to those copper producers contending with project cost inflation. If the shortage continues in the long term, the increased demand for the metal should be the spark that leads to increased investment in copper exploration and development.

What is the future outlook for copper?

A recent copper market overview report conducted by BMI, a Fitch Solutions research unit, indicated that this increased demand for the metal, along with a weakening U.S. dollar during the latter half of this year, could see copper prices continue to rise. If mining supply disruptions and an increased demand for copper persist over the next few years, the price of the metal is expected to rise by more than 75 per cent. BMI estimated that in the long term, the copper market will likely be in a sustained deficit as the energy transition will continue to require copper.