It has been a busy year for British Columbia miner Taseko Mines.

The company lost a defamation suit against an environmental group in January regarding articles about the potential environmental impact of its proposed New Prosperity copper-gold project, which the group posted during the federal environmental assessment’s public comment period. In February, the company launched a new lawsuit alleging the federal government did not meet its legal duties in the development of the New Prosperity project. Finally, a dissident shareholder group, Raging River Capital, called for a shareholder meeting in January.

The battle has been acrimonious. On Feb. 25, Taseko sent a press release accusing Mark Radzik, Raging River’s nomination for a Taseko board member spot, of failing to disclose his involvement in a corporate bankruptcy. (In an interview, Radzik said he was not a director at the time and claimed Taseko was attempting to direct the focus away from its performance.)

The dispute is rooted in a key disagreement: Raging River believes Taseko is underperforming and should focus on a few development projects and sell off non-core assets; Taseko’s current leadership disagrees with Raging River’s assessment and proposed strategy.

By definition, activist shareholders use their equity in a publicly traded company to force the company’s management to change something, like sell off assets or modify the shareholder or executive compensation structure. “[Shareholder activism] is just generally a reality – shareholders are being more responsible about their investing,” said Kingsdale Shareholder Services’ president Amy Freedman. (Freedman has been peripherally involved in the Taseko/Raging River case.) “It could be the beginning of a new chapter. At the end of the day, the goal is to maximize shareholder value.”

Proxy contests can happen when a shareholder or a group of shareholders have an opposing position to the company’s direction or the board’s strategy. Shareholders can hold a vote to apply pressure to the company; if they are successful, they can appoint a new director or a slate of new directors, push out an existing director or block a transaction.

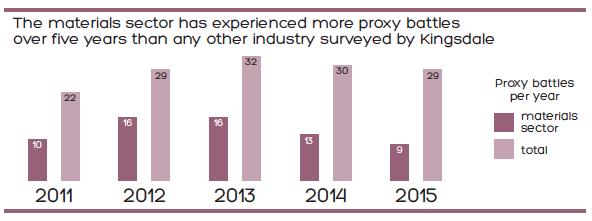

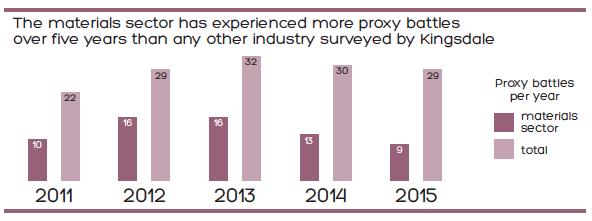

Companies faced 29 proxy contests across Canada as of September 2015, according to Kingsdale Shareholder Services’ latest proxy season review – which, the report noted, nearly matches 2014’s total. Nine of those contests were in the materials sector; another seven involved energy companies.

Indeed, Taseko is not the only company currently fending off an activist advance; a dissident group claimed Dominion Diamond’s share price fell because of poor management. In January, shareholders voted for a new board appointee, Josef Vejvoda – a portfolio manager from K2 & Associates Investment Management Inc., a company reportedly leading an activist group.

While the number of proxy contests is trending downward, Freedman noted reported figures are likely understating the situation. “People try to keep more out of the public eye,” Freedman said. “We work on many things quietly. You may see a press release go out that there’s a new board member or a strategic review, and it’s the result of activist activity in the background.” Cases typically go public when an activist has already tried to work with management, or when they believe the company will not act on their suggestions, Freedman added.

David Salmon, president of shareholder solicitation firm Laurel Hill Advisory Group, agreed there has been an overall increase in shareholder activism, “but not in traditional activism [like proxy battles].” (Salmon is directly involved with the Taseko/Raging River case.) Instead of fighting to change the company’s direction by appointing a new board member, Salmon said, activists have often tried to block specific transactions, mergers or acquisitions. Technology has enabled shareholders to communicate with each other and do their own research on transactions, Salmon said.

“Generally speaking, if you look 10 or 15 years ago, no one opposed a transaction. But you saw that last year,” Salmon added.

Salmon noted that even smaller shareholders have significant power today. One Fission Uranium shareholder, Jim Gifford, put together a coalition and blocked a merger with Denison Mines, Salmon noted, but Gifford’s own holding in the company relative to the potential value of the transaction was microscopic.

“It wasn’t an institution. This was a small guy that lived in a farming community in Ontario who got his message out there,” Salmon said. “The ability [of this shareholder] to articulate his arguments and get enough support such that a $900 million transaction is killed – I think that speaks volumes about the level of engagement.”

Why are shareholders getting involved now? The economy could be a factor. “[Shareholders are] losing money and they want to control as much as they can in those situations,” Salmon said. The number of proxy battles jumped after 2008, when the global economic downturn began, he noted. However, “the challenging economy was part of the reason, as many stock prices were down significantly, but not the only reason,” Salmon said. Ultimately, a company’s performance – and its shareholders’ fortunes – must be evaluated in the context of a downturn.

Taseko’s relative performance in the downturn is the driving factor for Raging River’s actions, said Raging River board nominee Mark Radzik. “We’ve watched our share price go down and we’ve seen action in millions of dollars go out, we’ve seen the CEO get a full bonus and full compensation, when in all the public documents it says he didn’t meet his objectives,” he said.

Taseko’s vice-president of investor relations Brian Bergot acknowledged it had been a “challenging couple of years for copper miners,” but added that activist investors may take advantage of frustrated shareholders. “I think they’re attacking Taseko because of the value of our assets,” he said. The suit the company has launched against the federal government regarding its assessment of New Prosperity is part of the effort to restore that value.

“We are not interested in litigation and being tied up in court. But we need to do what we have to do to ensure our projects get fairly assessed in the environmental process,” he added.

Taseko will hold a special meeting, as requested by Raging River, on May 10.