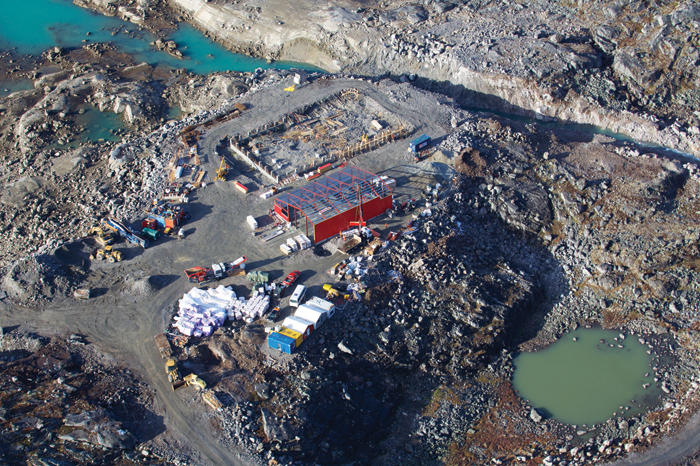

The camp (top left) and production facilities (centre) for the Aappaluttoq project in western Greenland. Courtesy of True North Gems

By some measures, the project is tiny.

Its capital cost is only $35 million. Its workforce, 45 to 50 workers for construction and around 60 for production, would barely count as a skeleton crew at some mines. Even Aappaluttoq’s open pit, at a couple of hundred square metres, is really not that large.

But in other important ways, Vancouver-based True North Gems’ (TNG) mine is huge. It is one of the first projects to make its way through Greenland’s new mining-friendly regulatory regime. Once Aappaluttoq is fully online, it figures to be a major player in the $2-billion global ruby industry.

And the grade of the mine’s Probable Reserves, 292 to 339 grams per tonne, compares well to Gemfields’ Montepuez operation in Mozambique, the only other large-scale ruby mine in the world, said Andrew Fagan, TNG’s project manager for Aappaluttoq.

Moving quickly

Ruby exploration in southwestern Greenland is not particularly new. Danish geologists first discovered gems in the region in the mid-1960s. A succession of Canadian and Danish companies removed promising bulk and mini-bulk samples from the region, although commercial production never took off.

True North Gems arrived in the area in 2004 and quickly began an aggressive exploration program that ultimately clinched essential financing for the mine last fall.

Construction on the mine began last October, and Fagan said the company will forego a traditional feasibility study, although it has issued two pre-feasibility studies, one in 2011 and one in March of this year.

What matters, he said, is the confidence the company has in the project’s geology and engineering. “The last pre-feasibility study that went through, it would normally be called a feasibility study,” said Fagan. The 2015 study includes a much more comprehensive pit design, mine schedule and processing flowsheet, opts for dense media separation and optical sorting rather than jigs, and nails down the tax and royalty numbers for the project. The difficulty in pricing ruby means a compliant feasibility study is not possible. “There is no spot price for rubies, which makes a feasibility study a difficult thing to do,” he explained. “Diamonds have a long-established history of published prices and a defined grading system – this is not the case for rubies and sapphires yet.”

“Coloured gemstone pricing is an extremely difficult thing to do,” said Hayley Henning, the company’s vice-president of marketing and development. “There is no manual, and because the Greenland material is new, there’s nothing to base a pricing structure on. We’ll work it out according to the market and depending on the quality of the material.”

Until Aappaluttoq begins producing stones later this fall, True North will not know the exact value of the gems, said Henning. “But we are excited given market indicators,” she added.

Mark Fedikow of North American Nickel describes the "tremendous advantage" of exploring in Greenland

For now, True North is focused on construction and financing. It found a unique way to tackle both those issues at once when, last October, the company closed an $11-million financing deal with LNS Group of Norway. The Norwegian mining and construction firm operates at producing mines in Scandinavia.

The deal with LNS Group offered True North $6 million in cash for a 27 per cent stake in the project, and an additional $5 million worth of construction work that will up LNS’ stake in Aappaluttoq. “They significantly cut our CAPEX by doing that arrangement,” Fagan said. LNS Group’s subsidiary LNS Greenland is doing the construction and mining for the project.

So far, construction of the main roads connecting the local port to the camp and processing plant site is finished. Fagan estimated camp construction is 80 per cent complete. The pit site is on a peninsula jutting into a nearby lake, and TNG plans to lower the water level by 10 metres, allowing them to build a road connecting the pit to the processing plant, a job that Fagan said is around 50 per cent complete.

The processing plant area is blasted, concrete for the workshop floor is poured and rebar for the site is being assembled. The processing plant equipment has all been procured and is awaiting the completion of the processing plant building. Pre-stripping work in the pit is scheduled to begin this fall.

Once mining is underway, production will ramp up, starting at 2,849 tonnes of ore in the construction-shortened first year, and topping out at more than 31,000 tonnes in the ninth and final year. The gem-bearing corundum grades are projected to average 292 grams per tonne over the life of the mine.

Waste rock at the open pit will be blasted, ore will be drilled and the drill holes connected with a production wire saw, common to the dimension stone industry. The sawed blocks will then be broken into smaller pieces with a rock breaker before being sent to the primary crusher.

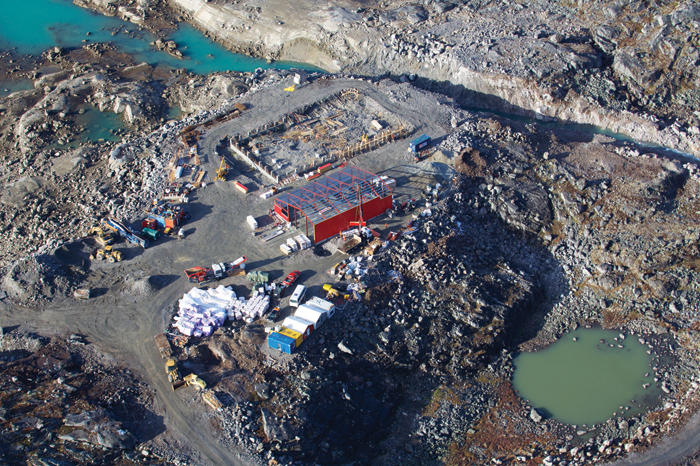

The workshop facility (red building) is nearing completion and the foundation for the process plant building has been laid. Courtesy of True North Gems

Logistics

Aappaluttoq is located 20 kilometres from the tiny fishing village of Qeqertarsuatsiaat (population 240), which is itself 150 kilometres from Greenland’s capital, Nuuk. Although that might sound remote, western Greenland actually enjoys a relatively mild climate and well-developed shipping infrastructure.

Fagan said temperatures rarely drop below -20 C, although an unusually cold winter last year slowed construction somewhat.

Shipping infrastructure in Nuuk is far more developed than in, say, the Canadian Arctic, with a full port that sees ships call daily. It is a small, out-of-the-way market, so shipping is relatively expensive, Fagan said, but the infrastructure is reliable. “The sea doesn’t freeze, so we have all-year shipping right up to our door,” he said. “And that ice-free shipping goes all the way up to Nuuk, so we actually have a pretty good logistical supply chain.”

But Qeqertarsuatsiaat’s small size limits the role it plays in operations. The company intends to use the local workforce, but the town lacks both a runway and a hospital. Nuuk, however, is a 45-minute helicopter ride away, so True North will operate its upgrading plant in an industrial park in the capital.

That plant will take dirty concentrates from the mine, with 20 to 30 per cent of the waste rock still attached, and run them through a hydrofluoric acid bath, which washes away the remaining silicates. From there, the clean concentrates can be further sorted and categorized.

The road to the outer port facility is currently being upgraded. Courtesy of True North Gems

A friendly, orderly place

Despite the unique logistical environment, Fagan said the company views Greenland as a mining-friendly jurisdiction. The government in Nuuk has long wanted to create greater independence from Denmark by replacing some of the $600 million in funding it gets from its colonial ruler with revenue from resource development. Greenland made the big leap to self government in 2009, and since then has courted development by overhauling its mining regulations and pursuing foreign investment.

Aappaluttoq is the first project to go through the new regulatory regime and into production, which among other things streamlines the public consultation process. Fagan said the system offers straightforward rules and a clear path for companies to convert exploration licences into mining licences.

“This is really part of Scandinavia,” he said. “There’s the rule of law. There are individual steps that you have to go through to get your licence, and at the end of the day your licence is available if you do all of those steps in the right way.”

TNG has also signed an Impact and Benefit Agreement (IBA) with the Government of Greenland and local communities. The IBA encourages the company to maximize the number of Greenlandic workers and mandates contributions to local education and social development funds.

“That IBA was fairly historic because it was the first one that had been signed under the new regulations,” Fagan said. “When we [signed] that on June 4 last year, it was a big signal that Greenland was ready for the mining industry to start.”

According to Fagan, the project boasts nearly 100 per cent Greenlandic employment. The only expat workers are people from True North’s head office and the occasional consultant.

The sorting plant will require some outside labour with specific training, but Fagan said that should be temporary. The company hopes to train local workers for those jobs, too, and leave those skills behind after the proposed nine-year mine life ends.  Clean rough gem corundum material ready to be graded into pink sapphire and ruby. Courtesy of True North Gems

Clean rough gem corundum material ready to be graded into pink sapphire and ruby. Courtesy of True North Gems

Marketing

Once the stones start coming out of the ground, the challenge will be to sell them. Although rubies and pink sapphires are highly prized, they are unquestionably a luxury item, and one with no industrial use.

Henning said the point of origin of True North stones adds another element of marketability. The fact that the stones are mined in Greenland will most definitely draw the attention of buyers.

“This is something completely new,” Henning says. “[Aappaluttoq] is a clean source with no environmental, governmental or human rights issues.”

Henning goes on to point out that the company has created a proprietary system called RubyTrack, designed to trace the movement of the gems from the mine, through the sorting and processing. It will allow consumers to trace each gemstone’s origin.

RubyTrack will assign barcodes to batches of sorted gemstones, so each can be sold with a certificate of authenticity, much like the way Canadian diamonds are marketed. Henning said she expects other players in the gemstone industry will adopt similar systems as the move toward greater accountability and transparency continues.

And while luxury items may seem a hard sell in turbulent economic conditions, Henning is confident True North and its rubies can weather the storm.

The workshop facility (red building) is nearing completion and the foundation for the process plant building has been laid. Courtesy of True North Gems

The workshop facility (red building) is nearing completion and the foundation for the process plant building has been laid. Courtesy of True North Gems The road to the outer port facility is currently being upgraded. Courtesy of True North Gems

The road to the outer port facility is currently being upgraded. Courtesy of True North Gems