Miners, caught up in the pandemic, are now seeking advice on how to react to the market. The pandemic has created some interesting opportunities: metal prices are decent; debt and equipment are dirt cheap; and equity capital has returned to the mining sector. Also, factor in that new technologies abound: remote work, once more niche, has become ubiquitous during COVID-19, while the use of renewable energy in the mining industry is being demanded by shareholders and citizens of the world alike. Miners should make the most of this moment, while keeping an eye to the future, post-pandemic world and the changes that will come.

The biggest change to keep in sight is that the market is moving east, from the North Atlantic and North Pacific to Asia. Management consulting firm McKinsey & Company sees Asia as having 52 per cent of the global GDP in 20 years time, whereas Asia had but 33 per cent in 2000. Add in the additional transport cost requirements from any mine on Earth to the Asian market, and the typical mining project will need to be increasingly cost conscious on both the CapEx and the OpEx.

Focusing on CapEx and OpEx

Metal markets: Today, with fewer new mines being found, mining is an increasingly depleting business. Since spring of 2020, many metal prices have been robust, and will be robust for some time to come, thanks to Chinese spending on infrastructure. Gold is now returning to a metal of safety as central banks are printing money. Copper is in demand, as always, and nickel is showing new demand as electric vehicles become increasingly popular. Zinc and lead, too, showed a market bottom in May 2020 and are now inching upward.

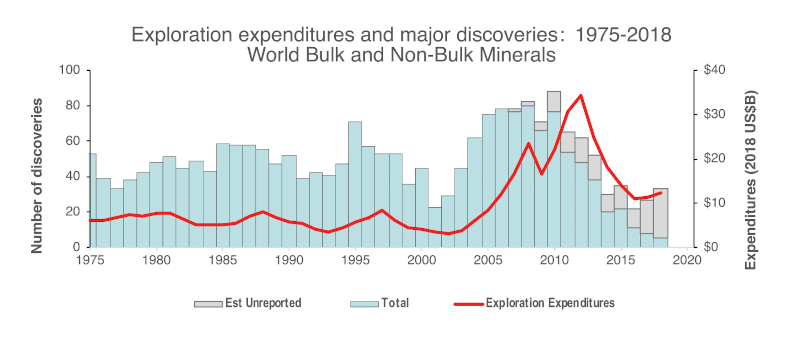

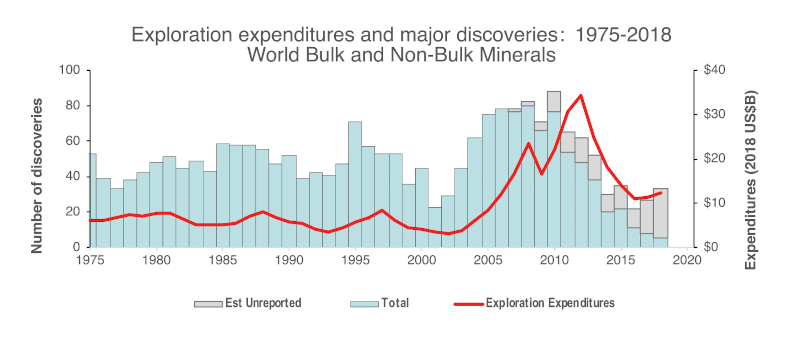

Exploration expenditures versus number of major discoveries, where major is defined as a gold deposit with more than one million ounces of gold or a copper deposit with more than one million tonnes of copper. Courtesy of MinEx Consulting

Exploration expenditures versus number of major discoveries, where major is defined as a gold deposit with more than one million ounces of gold or a copper deposit with more than one million tonnes of copper. Courtesy of MinEx Consulting

The location of the metal markets is the game changer. Canada has been spoiled by its proximity to most of the G7 markets, with the largest being just across a convenient border and the second and third largest to our immediate east and west, respectively. However, the Asian market beckons, stretching from Japan to the Middle East, with 60 per cent of the world’s population and an increasing slice of the global purchasing power. Hence, locating a new mine as close as possible to these emerging markets would be propitious. Otherwise, the onus will be on companies to reduce operating expenditures as much as possible in order to balance out the increased transport costs. One need only look at the liquid natural gas (LNG) market in Asia. With Asia’s exponentially increasing demand for LNG as an energy source, local production has increased alongside imports in order to keep costs as low as possible.

Related: What every metallurgist needs to read when it comes to comminution

Capital expenditures: According to the International Monetary Fund, we are still climbing out of the lockdown-induced global recession and production lines are empty and equipment lies unsold in inventories everywhere. This makes the timing good for miners to consider upgrading, possibly to the newer digital technologies now available – especially if newer, more efficient equipment can lower operating costs.

Renewable energy is also looking attractive as the cost of solar panels goes down and storage capability goes up. Look at what BHP has done at Escondido, committing to meet its 5 TWh per annum power needs through renewable energy sources, and the large-scale solar project that B2Gold is developing at its Fekola mine in Mali. Miners with projects situated anywhere between the latitudes 35 degrees north and 35 degrees south should definitely look at all renewable energy options.

The cost of capital: Debt costs have come down, primarily because of the recession, and will stay down for some time. Equity is once again available, because of the firming metal markets (though it will demand dividends), making it a good time to lock in some debt. And miners should keep in mind that interest is tax deductible, unlike dividends. Equity markets look at the price/cash flow ratio for dividend comfort. For equity, it is better to drill and then drill some more to keep up the largest cushion of Proven and Probable Reserves possible for dividend paying comfort.

The bottom line

The Canadian supply chain must increasingly stretch eastward beyond Japan into the rest of Asia, all while the cost and capital markets are changing. Mining projects must realign costs, both CapEx and OpEx, to a more distant market to be able to weather higher transport costs and remain cash-flow solvent in order to meet higher dividend demands. Fortunately, because of the current pandemic-related recession, and the fact that there are fewer mines being found, there are ample opportunities to re-equip a mine to achieve those lower costs.

Mauro Chiesa has over 35 years of experience in financing and advising extractive and infrastructure projects. He has worked with multinational banks in New York City, at the World Bank Group and EDC.