In search of answersCan innovative geoscience reverse the trend of declining discovery?

New mineral deposits are getting harder to find. Luckily, geoscientists like a good challenge. By harnessing innovative technologies and thinking outside the box, the exploration sector is searching for new ways to find the mines of tomorrow.

The mineral discovery rate is falling precipitously worldwide. Until a decade ago, it was commonplace for 70 to 80 moderately sized discoveries to be made every year, according to research by Richard Schodde of MinEx Consulting in Australia. Now, the industry struggles to find a couple dozen deposits annually as the search moves under cover of barren rock or sediments.

The consequence is that the world inventory of major metals is depleting rapidly. “When you look out over the next 10-20 years, the projected discovery rate isn’t enough to keep the market in balance,” Schodde said in an e-mail accompanying his latest report on mineral exploration published in November. According to his research, nickel and zinc in particular could suffer shortages, while lead and gold should hold up for now. “Copper seems okay, but that is based on a fairly conservative forecast for future metal production, which ignores any massive up-tick in demand from electric cars.”

The pressing question for the industry, then, is what can be done about the discovery crisis? While access to exploration financing and policy tweaks play a role, the answer appears to lie in a combination of initiatives: better use of emerging technologies, increased data integration and collaboration, a stronger focus on grassroots exploration under cover, and a replenished labour pool.

Today, a lot of the discussion about discovery rates revolves around how computing power that did not exist 10 years ago could transform the business of mineral exploration under cover. Artificial intelligence (AI) is, for example, a promising tool for finding patterns in the mountains of data the industry produces, while cloud computing provides a way for geoscientists to move beyond their desktop computers to collaborate in real time from anywhere in the world.

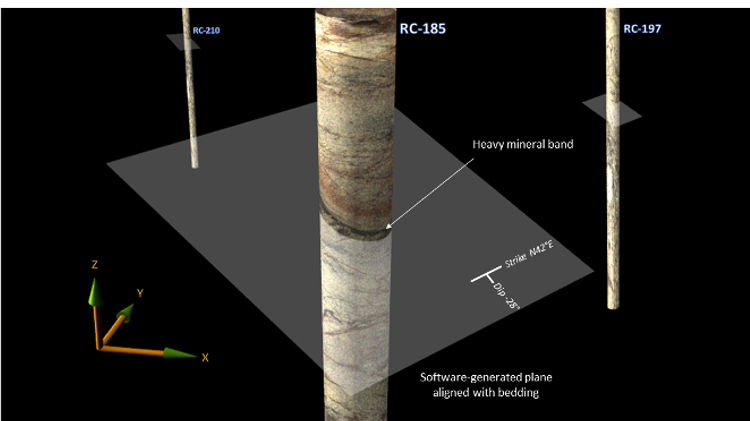

Though some of these sophisticated technologies may be out of the reach of the junior companies responsible for most of the world’s discoveries, technology does have a role to play in making exploration more efficient for them, said Mohan Srivastava, a geostatistician and vice-president of TriStar Gold, addressing the inaugural Progressive Mine Forum in Toronto last October. For example, TriStar avoids the expense of diamond drilling at its Castelo de Sonhos gold project in Brazil by using an optical televiewer, a relatively new technology, to provide high-resolution images of reverse circulation holes that help guide exploration at the project. Likewise, portable x-ray fluorescence (XRF) technology (for more information see Sharper shooters, pg. 66) has become routine in field camps over the past decade, allowing geoscientists to narrow down exploration targets without the long wait for results from the lab. GroundTruth Exploration’s “Drones to Drills” method combines both of these technologies, and more, with remote-controlled rotary air blast (RAB) drilling to provide a low-cost, more effective means to explore. The resulting data gets uploaded to the cloud so that GroundTruth’s geoscientists and clients can work on it wherever they may be.

An optical televiewer, which provides a high-resolution view of reverse circulation drill holes, generated this 3D image from TriStar’s Castelo de Sonhos project. Courtesy of TriStar Gold

An optical televiewer, which provides a high-resolution view of reverse circulation drill holes, generated this 3D image from TriStar’s Castelo de Sonhos project. Courtesy of TriStar Gold

AI and machine learning

A test of whether “educated” computers can help predict the next big discovery is underway along the Red Lake gold belt in northern Ontario. Goldcorp is feeding IBM’s Watson 60 years of historical data including geophysical and geological surveys, drillhole datasets, reports, academic papers and conference proceedings to teach Watson about the geology of the area and which exploration techniques work best.

The hope is that Watson will be able to churn through this vast amount of information, recognize patterns and spit out a prospectivity analysis the company can use to drive future exploration. “Once we have the data in place, we can apply some really clever technology including cognitive computing, machine learning and pattern recognition,” Robin Fell, Goldcorp’s director of strategic technology solutions, told the audience at the Progressive Mine Forum. “If the system understands your language and has a background in geology and ore deposits, then you’re essentially giving the power of 10,000 geologists to one geologist.”

Drill core racks at Goldcorp’s Red Lake project in Ontario. The miner recently teamed up with IBM’s Watson cognitive technology to analyze 60 years of historical data in the hopes of finding future exploration prospects. Courtesy of Goldcorp

Drill core racks at Goldcorp’s Red Lake project in Ontario. The miner recently teamed up with IBM’s Watson cognitive technology to analyze 60 years of historical data in the hopes of finding future exploration prospects. Courtesy of Goldcorp

As is often the case, the oil industry is years ahead of the mining industry in adopting AI technology. Woodside Energy in Perth, Australia, for example, has already reduced the percentage of their geoscientists’ time spent reading and searching for data to 20 per cent, down from 80 per cent, by using cognitive computing to combine 30 years of expertise with volumes of unstructured technical data, according to research by the IBM Institute of Business Value.

But in the end, machines are merely powerful tools that can augment but not replace the knowledge and intuition of geoscientists, said TriStar’s Srivastava. “Computers have a huge role to play in organizing and marshalling datasets, but we have to make sure human reason gets in there too.”

Mohan Srivastava, vice-president of TriStar Gold and a geostatistician by trade, proposes using conditional simulations to model a project and then generate funding to prove it. Presentation provided by McEwen Mining

Data integration, sharing and collaboration

The ability to integrate data from the three main geoscience disciplines (geology, geochemistry and geophysics) is improving rapidly as advances in 3D modelling combine with the power of cloud computing to produce robust models of the subsurface that geoscientists can share in real time. Recent efforts to increase discovery rates by harnessing these new tools to explore under cover are beginning to pay off.

Barrick Gold, for example, discovered the semi-concealed Alturas deposit on the mature El Indio gold belt in northern Chile by combining geological mapping, remote sensing, magnetic surveys and geochronology datasets to generate targets along the 150-kilometre belt. Further exploration within a 10-km2 vicinity of the top-ranked epithermal target defined subtle anomalies which, when integrated into the geological model, suggested a concealed target. Further data integration, including the results of drill core scanning and portable XRF, resulted in the discovery and delineation of 6.8 million ounces of Inferred Resources of gold at Alturas.

“One of the most significant aspects of the discovery has been the collaboration of a diverse group of geoscientists including field geologists with the support of highly qualified technical specialists,” Simon Griffiths, chief geologist for Barrick’s South America division, told his audience at Exploration 17. The conference, held in October, was the sixth of a series of meetings held in Toronto every 10 years since 1967 to highlight the latest developments in mineral exploration technology.

After the initial discovery at its Arrow project in Saskatchewan (above), NexGen Energy used a multidisciplinary approach in planning its step-out drilling. Courtesy of NexGen Energy

After the initial discovery at its Arrow project in Saskatchewan (above), NexGen Energy used a multidisciplinary approach in planning its step-out drilling. Courtesy of NexGen Energy

Major companies tend to be better at integrating data because they possess the financial and human resources to tackle the challenge, and often massive amounts of their own historical data to draw upon. But some juniors are succeeding with this approach too.

NexGen Energy, the 2018 winner of PDAC’s Bill Dennis Award for exploration and development success, used multidisciplinary exploration techniques in the Athabasca basin in Saskatchewan to find Arrow, one of the world’s biggest undeveloped uranium deposits. The exploration team combined historical data publicly available from the province with results from geological mapping, geochemical sampling and geophysical surveys, then assigned each data layer a different weighting to prioritize targets. For example, historical drillholes with good geology, alteration, structure and radioactivity received high priority weightings, while geochemical anomalies from soil sampling received lesser ratings because the area is so heavily glaciated. This methodical approach allowed NexGen to step out with confidence from the initial blind discovery because the team developed a good understanding of the controls on mineralization.

In 2015 Integra Gold made data sharing newsworthy by creating a $1-million contest for the best proposal to find more ore at its Lamaque gold project near Val-d’Or, Quebec, by using existing data. The junior opened Lamaque’s database to geoscientists, game designers and medical researchers worldwide, receiving 1,000 submissions from 65 countries. Quebec-based SGS Geostat won the prize for combining artificial intelligence, data analytics and virtual reality in an interactive 3D space to pinpoint new targets. In mid-2017, Eldorado Gold purchased Integra Gold for $590 million on the strength of Lamaque’s growing resource base and exploration potential.

Jean-Philippe Paiement explains how SGS have combined historical geological data with machine learning and virtual reality tools to identify and visualize drilling targets. Presentation provided by McEwen Mining

On a broader scale, PDAC hopes to increase the amount of geoscience data sharing in Canada with the introduction of exploration assessment guidelines – known as Exploration Assessment Digital Data Formats (EADDF) – that will provide a national standard for recording exploration information across various jurisdictions. “Assessment files become bigger and bigger every year but the data remains either on paper or as a PDF format. Compiling this information is very costly and time consuming,” said Charles Beaudry, chair of PDAC’s geoscience committee, who launched the EADDF guidelines at Exploration 17. “This is why PDAC is advocating for jurisdictions in Canada to require explorationists to submit their assessment data in a consistent digital format.” Australia has had similar guidelines in place for years.

One risk is that as exploration technology – particularly geophysical techniques – becomes more specialized, geoscientists may retreat even further into their silos rather than sharing and collaborating, said Ken Witherly, president of Condor Consulting, during Exploration 17’s panel discussion on integrating the geosciences. “Once those silos are created, it’s difficult to get people to share information. Their tendency is to pass on their contributions as if they were on a GM assembly line, but geoscience doesn’t work that way.” Witherly is on the board of the NSERC-CMIC Industrial Research Network, a consortium that seeks to use integrated geoscience to define the footprints of ore systems by vectoring from their distal margins to their high-grade cores. The network’s ultimate goal is to develop new technologies and methods that can be used to detect subtle targets under cover.

Related: Carl Weatherell on the power of planned innovation

Industry-government-academic consortiums such as NSERC-CMIC Footprints can be an effective way to move the needle on technology because they put the weight of industry and government funding behind academic research. Another example is Metal Earth, a consortium led by Laurentian University in Sudbury that seeks to understand how ore deposits are distributed in Precambrian rocks and why some areas have rich mineral endowments while others are barren. The $104-million program aims to help unlock new mineral riches in Canada’s Far North, which remains underexplored compared to the Precambrian terrain south of 60° N latitude where close to half of Canada’s gold and base metal mines lie.

Grassroots exploration under cover

The exploration spending boom of 2006-2011, before the sector hit the latest doldrums, was characterized by spending on existing deposits. The hope was that higher commodity prices driven by strong growth in China could turn marginal deposits into economic ore bodies, allowing the sector to sidestep the risk of early stage exploration. Globally, the share of spending devoted to grassroots exploration dropped to 28 per cent in 2016 from 48 per cent in 2003 according to SNL Metals & Mining. Unsurprisingly, the number of fresh discoveries tumbled in tandem.

Tier 1 discoveries such as the Ekati diamond deposit in the Northwest Territories and the Voisey’s Bay nickel deposit in Labrador – both found in the 1990s – resulted not from perusing old drillhole datasets, but from methodical exploration in remote parts of Canada that had seen little exploration in the past. Although areas that have both mineral potential and outcrop are becoming scarcer, there is vast potential to discover new mineral systems obscured by cover. The main obstacles to discovery are the expense and high failure rate of exploring blind.

Related: Drillhole placement subject to constraints for improved resource classification

The Deep Exploration Technologies (DET-CRC) research centre in Adelaide, Australia, another industry-government-academic collaboration, aims to address those obstacles by introducing a prospecting drill that can investigate covered mineral systems quickly and inexpensively. The RoXplorer, the result of seven years of research, uses coiled-tube drilling instead of traditional drill rods to reduce costs and improve safety and expediency by eliminating the need for drill rod changes. Sensors on the drill string provide real-time information about the properties of the underlying rocks, allowing exploration managers to adjust their drilling program on the fly. DET-CRC is expected to offer RoXplorer to its industry partners for licencing following successful field trials earlier this year.

A bigger, better labour pool

But no matter how much money and technology the industry throws at mineral exploration, discoveries cannot happen without expertise. A recent survey of the exploration sector by the Mining Industry Human Resources Council (MiHR) suggests there has been a significant hollowing out of mid-career (aged 35-54) geoscientists, who are crucial for mentoring and transferring expertise to recent graduates. A majority of the 397 respondents to MiHR’s survey were either in the 15-34 or 55 and over age group, while the middle-age range was significantly underrepresented compared the rest of the mining labour force and Canadian workers in general.

The case for geochemists is especially dire. There has been a severe loss of middle management in the Association of Applied Geochemists, Peter Winterburn, industrial research chair at UBC’s Department of Earth, Ocean and Atmospheric Sciences, told the Exploration 17 audience. About 50 per cent of geochemists are over 60, while only 13 per cent are under 40. And because most are contractors, data integration has fallen by the wayside. “Even in lean times, consultants are turning away work because there is more than they can handle. This points to a severe deficiency of geochemists in the industry.”

The Arrow deposit in the Athabasca basin earned NexGen the 2018 PDAC Bill Dennis award for success in exploration and development. Courtesy of NexGen Energy

The Arrow deposit in the Athabasca basin earned NexGen the 2018 PDAC Bill Dennis award for success in exploration and development. Courtesy of NexGen Energy

There have been some initiatives to encourage more students to pursue careers in mineral exploration while embracing a multidisciplinary approach. For example, the Frank Arnott Award presented at Exploration 17 awarded prizes in the “apprentice” category for teams of undergraduates able to demonstrate innovation in data visualization and integration using one of five regional datasets. Team “On the Rocks” from the University of Adelaide won first place for its 3D projections and presentation of geoscientific data from the mineral rich Gawlor Craton in southcentral Australia.

But universities and colleges need consistent funding for geoscience training, including the more practical field schools, if they are expected to continue to supply the next generation of explorers. And companies must find a way to retain those recruits through inevitable commodity price swings, or they risk losing even more expertise at the crucial mid-career stage.

The declining rate of mineral discovery and the associated challenges of waning expertise and exploring under cover paint a bleak picture of the future of mining. But the mineral exploration sector is nimble and big discoveries such as Ekati have a way of turning the sector on its head, fuelling more exploration and making the industry attractive to prospective geoscientists. If new technology – be it IBM’s Watson, DET-CRC’s prospecting drill or some as yet unknown technique – leads to a world-class discovery, sector players will be quick to try to replicate the success. The resulting investment could herald a new era of discovery under cover that, in turn, leads to the next generation of mines.

More Projects

Quebec’s golden pockets

Exploration is stagnant around most of the world, but Quebec’s gold camps in the Abitibi and James Bay regions offer a ray of light in an otherwise dark tunnel

Hope for the future

TMAC’s high-grade Hope Bay gold project in the Kitikmeot region of Nunavut is nearing start up