Quebec’s golden pocketsTwo regions of La belle province are seeing increased exploration activity in the gold sector

Exploration spending is down across the board, but budgets for gold exploration have suffered less than other metals. And in two particular regions of Quebec – the established Abitibi gold belt and the emerging James Bay region – exploration drills are busily biting the rock.

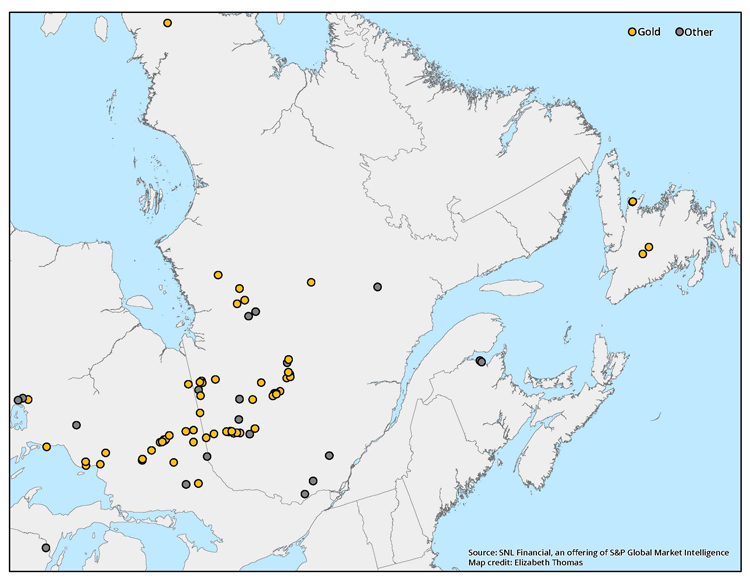

The latest map of exploration drilling in Canada resembles a nighttime satellite image of the country: vast expanses of monochrome punctuated by clusters of brightness. If the clusters represented urban areas, the Abitibi greenstone belt straddling the Quebec-Ontario border would be a bustling metropolis and the James Bay region a small but growing municipality.

Despite a global slowdown in exploration spending that S&P Global Market Intelligence expects to continue into 2017, pockets of Quebec could be on the cusp of an upswing. The province’s share of Canadian drilling activity averaged about 30 per cent in the first nine months of 2016, reaching almost 40 per cent in August, according to analysis by S&P Global.

The provincial hotspots are at opposite ends of the exploration spectrum: the James Bay camp on the province’s western limit hosts greenfield projects, whereas the well-established Abitibi belt to the south hosts several producing mines. The latter is benefiting from the perception of safety while the former is attracting investors willing to accept greater risk in exchange for the potential gains associated with discoveries in an emerging mining camp.

Silver and specialty metals represent some of the targets, but the majority of Quebec’s drilling projects (11 of the 15 recorded in August 2016) are focused on gold, mirroring a worldwide phenomenon.

“Investors understand the gold sector better than any other commodity, so when the gold price goes up, they are ready to contribute to exploration by participating in financings or buying shares on the market,” said Gérald Riverin, president of Yorbeau Resources, which recently raised $1.28 million in flow-through financing for its gold and base metal projects on the Abitibi belt.

Gold climbed sharply in the first half of the year, touching a high of US$1,367 per ounce, before retreating to the US$1,300-per-ounce level by the end of the third quarter as the odds of an interest rate hike by the U.S. Federal Reserve increased amid stronger economic conditions in the country.

Thomson Reuters expects the price to rally further in 2017 as physical demand accelerates, matching the average US$1,420-per-ounce price in 2010. A recent Reuters poll of 35 analysts and traders returned a slightly lower annual average gold price forecast of US$1,331 per ounce if expected interest rate hikes in the U.S. come to pass.

Quebec on the rise again

After sliding back for a few years amid complaints of red tape and anti-mining sentiment, Quebec appears to be regaining its place among the most attractive regions in the world for mining and exploration. According to the Fraser Institute’s annual survey of the mining industry, Quebec and Saskatchewan were the only Canadian jurisdictions to place in the top 10 worldwide for their perceived overall investment attractiveness in 2015. Quebec ranked first in the world from 2007 to 2010, but slipped to 11th place in 2012.

Another positive indicator for the province is the recent return of a major gold producer to the Abitibi belt. Kinross Gold is drilling at Yorbeau’s Rouyn property about four kilometres (km) south of Rouyn-Noranda after signing a deal to earn a 100-per-cent interest in the project. Rouyn represents a consolidation of several properties covering a 12-km stretch of the Cadillac-Larder break, a major fault zone in the Abitibi that stretches 250 km from west of Kirkland Lake, Ontario, to east of Val-d’Or in Quebec.

Kinross has not invested so heavily in the Abitibi since 1999, when it suspended operations at its Macassa gold mine on the Ontario side of the belt. The major did not respond to a request for an interview about plans for the Rouyn project, but in order to earn full ownership, Kinross must complete a resource estimate after spending $12 million on exploration. In the first 18 months, the agreement calls for $3 million in spending, including at least 12,500 metres (m) of diamond drilling.

“Rouyn has good road access, so the drilling costs are relatively low,” said Riverin. “Kinross should be able to mount a significant exploration effort for that amount of money.”

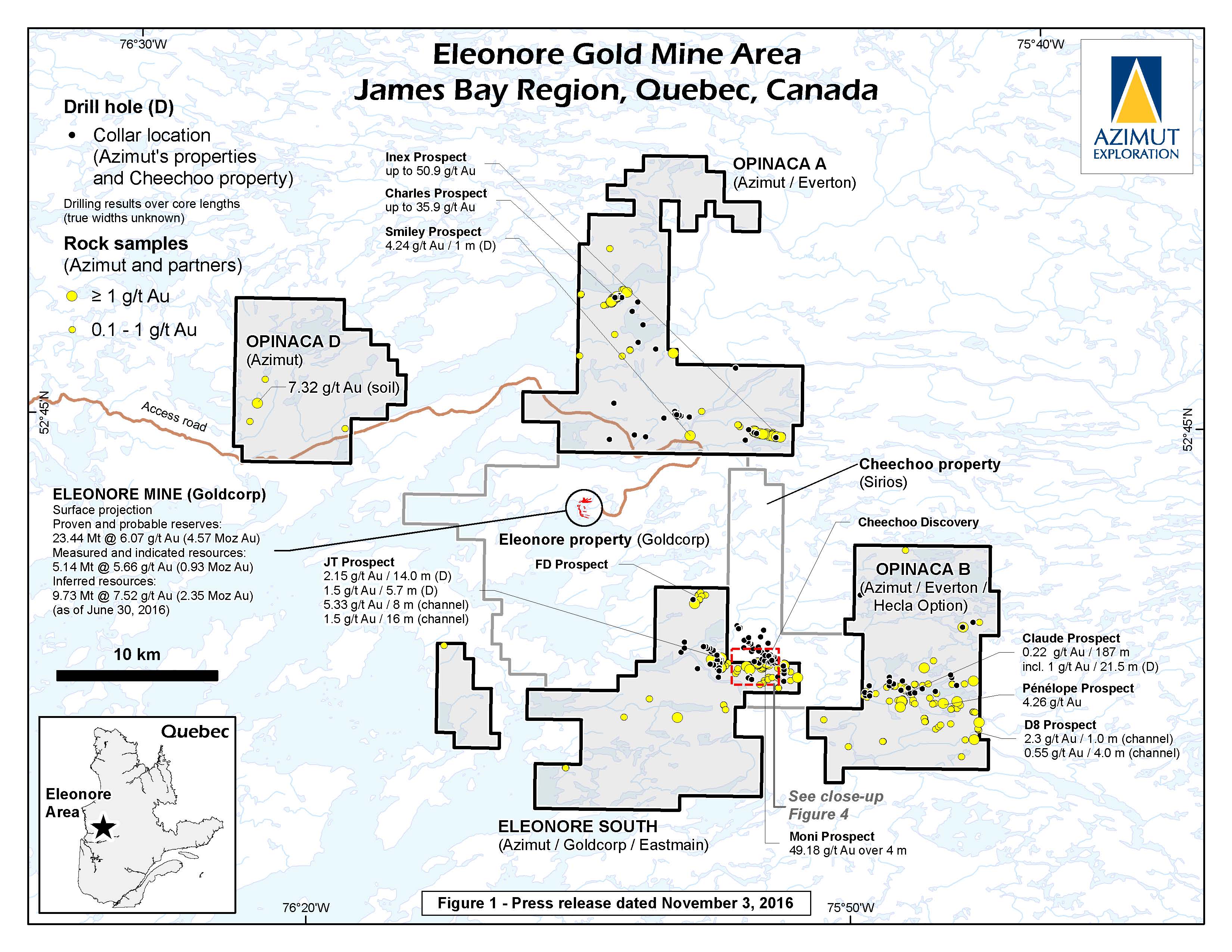

In the James Bay region, about 600 km north of the Abitibi, several juniors are attempting to replicate the success of the Éléonore gold discovery by Virginia Gold Mines in 2004 in metamorphic rocks near the contact between the La Grande and Opinaca geological sub-provinces. Goldcorp, which bought Éléonore in 2005 for US$420 million and achieved commercial production in 2015, said it expects to ramp up production at the mine to 7,000 tonnes per day by the first half of 2018.

Drilling activity in eastern Canada between Jan. and Sept. 2016

Drilling activity in eastern Canada between Jan. and Sept. 2016On safe ground in the Abitibi

The Abitibi belt is an estimated 2,800 million years old and has produced about 170 million ounces of gold since mining started there more than a century ago. It is one of the largest Archean greenstone belts in the world.

Most of the major base metal and gold mining camps on the Quebec side – Malartic, Rouyn-Noranda, and Val-d’Or – fall along the east-west trending Cadillac-Larder fault zone. Other well-known camps, including Casa Berardi and Matagami, occur along the Casa Berardi and Sunday Lake fault zones in the northern part of the belt.

Although the Abitibi has undergone several cycles of exploration and development since 1901 and may have peaked in terms of gold production, explorers see potential for more ore to be found, especially at depth.

“A common feature of the Abitibi gold deposits is that they persist at depth,” said Riverin. “It is a more mature area, but with continuing improvements in mining technology, people can now mine a lot deeper than in the past and still make money.”

For example, Agnico Eagle Mines, Quebec’s largest gold producer, is assessing the potential of mining more than 3.1 km under the surface at its LaRonde mine between Rouyn-Noranda and Val-d’Or. The company is infill drilling from the 311 level to the 371 level with a focus on the western portion of the deposit and will test the eastern portion as underground development expands.

Agnico expects annual production from LaRonde to top 300,000 ounces from 2017 on (from about 268,000 in 2015) as gold grades increase at depth.

Efforts in the Abitibi also appeal to investors reluctant to fund projects that are perceived to be too risky, said Mark Ferguson, head of mining studies for S&P Global. “Investors are focusing on belts that are more established. We are not seeing as much of the more remote drilling.”

The most active gold projects on the belt, aside from the Yorbeau-Kinross joint venture, include:

Detour Trend, Balmoral Resources: Balmoral raised $7.1 million in flow-through financing last summer to continue exploration on its Detour Trend and other projects in the Abitibi. The company is focused on defining a high-grade gold system on its Martiniere property, where mineralization occurs along two major structural trends, Bug Lake and Martiniere West. Together the trends extend for more than 1,900 m along strike and to depths of over 400 vertical metres. Both trends remain open at depth and recent drilling returned an intercept of 4.51 grams per tonne (gpt) gold over 26.9 m in veins in the hanging wall of the Bug South deposit.

Odyssey, Agnico Eagle & Yamana Gold: The co-owners of the Canadian Malartic mine west of Val-d’Or, one of Canada’s largest gold mines, completed advanced drilling at the Odyssey deposit to the east of the mine with the goal of reclassifying the mineralization as Inferred Mineral Resources. They continued drilling in the fourth quarter to better define potential high-grade cross cutting structures. Odyssey is envisioned as a bulk tonnage underground deposit that could provide a new source of ore for the Canadian Malartic mill, according to Abitibi Royalties, which holds a three per cent net smelter royalty on the Odyssey North discovery.

Douay, Aurvista Gold: In early November, Aurvista was expecting to close a $6 million private placement to fund ongoing exploration at Douay, which covers a 20-km segment of the Casa Berardi fault zone. The project contains 2.7 million tonnes of Indicated Resources grading 2.76 gpt gold and Inferred Resources of 115 million tonnes grading 0.75 gpt gold. The company is planning 4,000 m of drilling to delineate additional gold mineralization there.

Gladiator, Bonterra Resources: Bonterra is conducting a 25,000-m drill program to expand an Inferred Resource of 905,000 tonnes grading 9.37 gpt gold at the Gladiator project along the Casa Berardi fault zone northeast of Val-d’Or. The company has been successful in extending the high-grade gold zone down plunge and to the east, and added a second rig to the project in November.

Lamaque South, Integra Gold: The Lamaque South project and Sigma-Lamaque mill and mine are located directly east of the city of Val-d’Or. Among other initiatives, Integra is drilling a 2,000-m long “parent” hole to test whether mineralization at the neighbouring Sigma and Lamaque gold mines coalesce at depth. Meanwhile, the company has launched a 2,500-m program to test a new target, the Sigma East Extension, identified by a data compilation exercise and corresponding to a magnetic anomaly located 750 m east and along strike of the Sigma mine.

The discovery and development of the Éléonore gold deposit has fueled exploration activity in the James Bay region. Courtesy of Azimut Exploration Inc.

The discovery and development of the Éléonore gold deposit has fueled exploration activity in the James Bay region. Courtesy of Azimut Exploration Inc.Blue Skies in James Bay

James Bay, on the other hand, has managed to convince wary investors to give it a shot, thanks to the development of the Éléonore gold discovery just over a decade ago into a producing mine today.

The presence of such a long-life, high-grade mine at Éléonore (the main Roberto deposit has Proven and Probable Reserves of 4.57 million ounces of gold grading 5.87 gpt and another three million ounces of Resources) has created a sustainable exploration dynamic in the region, said Jean-Marc Lulin, president of Azimut Exploration, which has been an active explorer in the James Bay region since before the Éléonore discovery on the Opinaca Reservoir.

“It’s a large area of attractive geology with several unexplored or underexplored greenstone belts,” he said. “Another benefit is an outstanding (geoscience) database that allows us to reduce the exploration risk and develop better targets. When you combine these two factors, the area becomes very attractive.”

The Roberto deposit differs from the brecciated and vein-type gold deposits that characterize the Abitibi region in that it consists of stockwork and replacement style mineralization hosted by greywackes and paragneiss, according to a 2010 report on the deposit by the Geological Survey of Canada.

James Bay, once too remote and expensive to attract much exploration spending, is also starting to benefit from infrastructure projects under the auspices of Plan Nord, a commitment by the province to spend about $1.3 billion on infrastructure and other projects by 2020 in the hopes of attracting $22 billion in private-sector investment north of the 49th parallel.

For example, Hydro Quebec’s $5-billion Eastmain 1A-Sarcelle Rupert project, completed in 2012, brought both added power and new roads to the region. Plan Nord was also instrumental in extending Route 167 another 240 km north to the new Renard diamond mine, allowing mine owner Stornoway and the region’s explorers to bring in supplies overland instead of by plane and helicopter.

“Over the past 20 years, there has been a lot of unique infrastructure spending and we’ve seen a huge improvement in our ability to access the James Bay area,” said Joseph Fazzini, CFO and vice-president of corporate development for Eastmain Resources, another significant claimholder in the region that has an advanced exploration property along the Route 167 extension. “It makes it a lot more compelling to explore if you know you’ll have roads and power lines when you need them.”

Because the Société du Plan Nord acts as more of a coordinator than the lead on projects, its influence is not always obvious, said president and CEO Robert Sauvé. He said Plan Nord’s goal is to try to assist business ventures while supporting the communities in the north through infrastructure building and training.

“We’re coordinating the implementation of new infrastructure and the maintenance of existing infrastructure in the north including roads, railway and airports,” he said. “For instance, the James Bay road (which starts in Matagami and ends at Radisson) has become strategic to mining development and we will coordinate all the departments to improve the road within the next few years and reduce the cost of access.”

The most active gold exploration projects along the Opinaca-La Grande tectonic boundary in James Bay include:

Éléonore, Goldcorp: Armed with a better understanding of the mineralizing system at Éléonore, Goldcorp is developing a predictive model that can be applied to exploration elsewhere in the region. The company has identified a northeast-southwest glacial float train within a 10-km radius of the mine that contains mineralized boulders with high-grade gold. Ground geophysics is underway to better define the possible bedrock source of the boulders and to site trenches and/or drill holes planned for the first quarter of 2017.

Channel sampling of the Moni prospect at Eléonore South. Courtesy of Azimut Exploration Inc.

Channel sampling of the Moni prospect at Eléonore South. Courtesy of Azimut Exploration Inc.Éléonore South, Eastmain (36.7%); Goldcorp (36.7%); Azimut Exploration (26.6%): This early-stage project is located about eight km south of the Éléonore mine and is underlain by the same rock formations as those on the mine property. The prospective corridor extends over an area at least three km long by 500 m wide. A 5,000-m drill program returned initial results of 76.1 gpt gold over 1.55 m and 0.62 gpt gold over 79.1 m in November. “The association between mineralized tonalitic and pegmatitic facies over significant widths along the margins of a tonalite intrusion suggests a large-scale hydrothermal-magmatic mineralized system,” said the partners in a joint release.

Cheechoo, Sirios Resources: Situated adjacent to the Éléonore mine property, Cheechoo hosts a low grade (0.3-0.8 gpt gold) mineralized envelope which extends for more than one km along strike, is 300 to 450 m wide, and has a vertical depth of more than 340 m. In mid-2016, a 10,000-m program intersected 4.18 gpt gold over 20 m within a tonalitic intrusion near the contact with surrounding metasediments. In October, the Quebec Mineral Exploration Association gave Sirios the Discovery of the Year award for its success at Cheechoo.

The Eau Claire deposit outcrop. Courtesy of Eastmain Resources

The Eau Claire deposit outcrop. Courtesy of Eastmain ResourcesClearwater, Eastmain Resources: Over the past few years, Eastmain has focused on expanding and defining the high-grade Eau Claire gold deposit at the western end of the Clearwater property, where Measured and Indicated Resources stand at 7.23 million tonnes grading 4.1 gpt gold for 951,000 ounces. The current 63,000-m program is focused on infill drilling and testing additional targets along the structural deformation zone that hosts Eau Claire. “We’re looking forward to releasing those results over the next few months and putting them into a new resource update planned for the first half of 2017,” said Fazzini.

Midland-Osisko Joint Venture: The two juniors are combining efforts to explore settings favourable for gold deposits in the vicinity of Éléonore. This year they have budgeted $1 million to investigate properties covering a surface area of about 953 square km. Phase one of the land program includes till and lake-bottom sediment sampling.

Sakami, Matamec Explorations & Canada Strategic Metals: The partners conducted a $700,000 exploration program to test four separate areas on the property, including a 2,000-m drill campaign on the La Pointe sector where a gold zone (Zone 25) has already been identified. Drilling on the northwest extension of Zone 25 returned an intersection of 1.87 gpt gold over 27 m.

Azimut Exploration/SOQUEM Strategic Alliance: The alliance led to the acquisition of four properties following regional-scale mineral potential modelling over 176,300 square km by Azimut. The properties cover 658 square km and display strong multi-element geochemical footprints for gold in lake-bottom sediments, along with favourable geophysical, geological and structural criteria. “We try to address the exploration risk at the very early stages of the project by outlining the best targets possible through data processing and reduce the business risk by involving good partners,” said Lulin of the company’s strategy.

While S&P Global expects worldwide exploration spending to decline another 20-25 per cent in 2016 from a six-year low of US$9.2 billion in 2015, exploration in Quebec – particularly in the Abitibi and James Bay gold camps – appears to be attracting more attention, according to drilling activity monitored by the market analytics group. If the activity translates into discoveries, Quebec may find itself back at the top of the rankings for investment, a position that has eluded la belle province for the past five years.

More Projects

Hope for the future

TMAC’s high-grade Hope Bay gold project in the Kitikmeot region of Nunavut is nearing start up

The life aquatic

Why Germany is eyeing up the Pacific seafloor