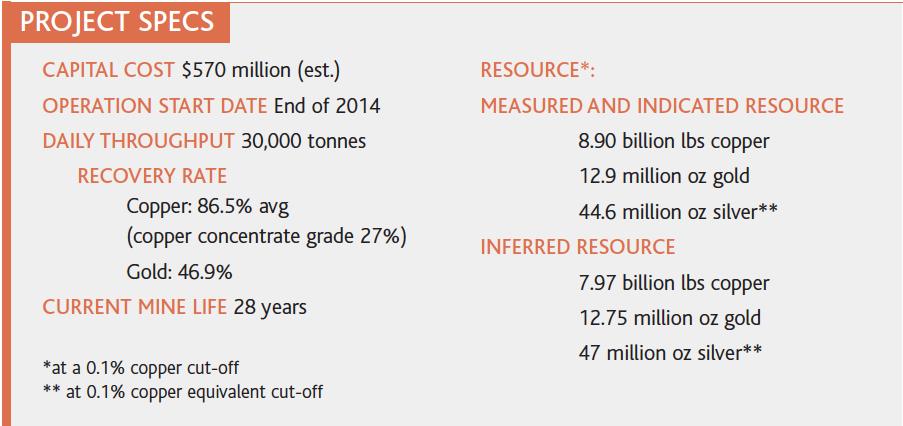

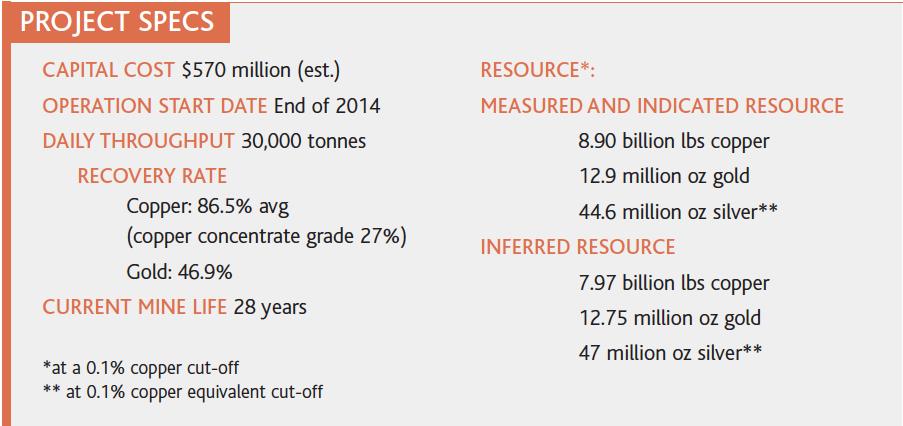

Imperial Metals is already an established operator in British Columbia, with its Mount Polley and Huckleberry mines. The development of the Red Chris project in the province’s northwest, however, will springboard the company from a well-capitalized mid-tier producer to a powerful mine developer. To get there, the company is relying on a experienced team with a thrifty streak to complete the $570 million-project and bring it into production later this year.

Tim Fisch, the general manager of Red Chris, gives off a confident, calm aura for someone under the pressure of getting construction completed under time and budgetary constraints. Even with some nine different contracting companies working simultaneously to meet a swath of deadlines, he is able to make time to tour the operation. In addition to putting the finishing touches on the mill, a metallurgical lab and other key components, the copper/gold mine is waiting on power from BC Hydro’s Northwest Transmission Line before production can begin. But, it became clear Fisch’s poise stems from a deeply held trust in the experience of the team which extends from head office down to the people working on site day to day.

Red Chris general manager Tim Fisch details the development of the processing plant. Peter Braul

Red Chris general manager Tim Fisch details the development of the processing plant. Peter Braul

Take Jack Zuke, for example, who came out of retirement to refurbish the P&H 2800XPC shovel that Imperial bought from Northgate Minerals’ recently closed Kemess operation. “It’s what he’s done all his life: take shovels apart and put them back together,” says Fisch. “He could tell you where every shovel in North America is, when it was made, how it runs. Jack and his hand-picked team are putting that shovel together for a fraction of the cost of what other companies would charge. It’s an example of that experienced team that we have that knows where to take the shortcuts, and the tricks of the trade.”

“This machine here, to buy it new would probably be about $26 million,” Zuke reckons of the rope shovel, which will deliver 59-tonne buckets of copper porphyry ore into Caterpillar 793F haul trucks once extraction is underway. “It’ll be like a new machine when we’re done with it, and probably cost about $8 million.”

And Zuke, with over 60 years working on shovels, is far from the only veteran at the new mine. Every direction we turn, Fisch has an easy, familial relationship with the people that are driving the project forward.

Reliability minded

With first electrons set to flow to the site this August, Fisch hopes everything will be ready to power up by then, with the principal draw coming from the 30,000 tonne-per-day mill. There, again, Imperial has saved money by bringing in the SAG mill from Kemess, and combining it with new ABB variable frequency drives and a new 24-foot ball mill from FLSmidth. “I’m anxious to see what kind of production we can get out of this installation,” Fisch says, looking forward to the task of coaxing the best performance from this mix of old and new components. “Over the years I’ve found that some used equipment tends to be more reliable in the long run.”

Prior to taking on the job at Red Chris, Fisch was the general manager for the company’s Mount Polley Mine. Over his career, he has amassed decades of experience managing mill operations in Canada and the United States. As he tours the facility, it is apparent he is constantly doing a visual inspection, taking stock of progress and squaring reality with the engineering drawings hanging on his office wall.

Of the new equipment, Fisch is most excited about the ABB drives used on the SAG and ball mills. “The drives for both mills are identical,” he explains. Both mills use two 9,000-hp variable frequency drives, so the SAG mill will probably not draw the full nameplate horsepower. “It probably will only draw about 14,500 horsepower at the top end. However, we were able to keep capital costs down by only purchasing one spare motor.” New meets old again as the ore makes its way towards flotation cells in the regrind circuit, where the design has a small ball mill from Imperial’s Mount Polley mine matched to a brand-new Metso vertical mill. The entire plant has been developed with flexibility in mind, and depending on the ore’s hardness, it can be treated differently.

Geography

Like all of Imperial’s operations, the products of Red Chris’s mill are likely destined for Asian consumers. The copper-gold-silver concentrate will be loaded onto B-train trucks at the mine, and shipped some 325 km to the coastal town of Stewart, before heading across the Pacific.

That drive – across a wilderness whose beauty needs to be seen to be believed – is the clearest explanation why Imperial has made the environment surrounding the mine a priority. To oversee the mine’s environmental monitoring plan, two years ago Imperial hired Jack Love.

Red Chris is located on a treeless expanse known as the Todagin plateau that overlooks a deep valley and is surrounded by jagged peaks, including Todagin Mountain. It is traditional Tahltan territory, but besides First Nations, very few people have a better grasp of the area than Love. “We are wedged between two of the nicest parks in the province,” he says. “We have the Spatsizi Plateau Wilderness Park 15 km northeast and the Todagin South Slope Park to the south.

“We are in the headwaters of two systems, which makes water monitoring very challenging,” Love adds. “These little streams – they are pristine. They are ultra-low level clean. If you could run a pipe of this water to California, you’d be a billionaire. But because everything is so clean here you can see every little blip.” Love says his objectives for the mine’s effluent are aquatic life guidelines typically 10 times more stringent than for drinking water.

Jack Zuke (right) put off retirement to help prepare the mining fleet for production. Peter Braul

Jack Zuke (right) put off retirement to help prepare the mining fleet for production. Peter Braul

Love explains that his job includes monitoring groundwater to an extraordinary degree of accuracy. In addition to the wells within the mine’s footprint, more than 20 groundwater monitoring wells have been drilled outside of it, which he says produce an enormous quantity of data. “If you’re familiar with models, the more data the more certainty and the more comfort you have.”

In addition to fish habitat monitoring, Love has also installed motion sensing cameras in the surrounding region which register animal movement and will be able to monitor any reactions to blasting in the mine.

Love compiles his reports every two weeks and updates the local Tahltan First Nation. The Tahltan, initially wary of the project, have since come around to it and are actively involved in development. A sizeable proportion of the construction workforce comes from local communities. Because the mine will inevitably have its impacts, everyone involved has had to reconcile the economic windfalls with the transformation of the landscape that is now underway. But due to large projects like Red Chris, the local Tahltan communities also have very low unemployment rates. Though the two parties have not finalized an impact benefit agreement for the life of the mine, negotiations are underway.

Trust

The First Nations are now invested in Red Chris’s success, both economically and environmentally, and the partnerships that have been formed bode well for the long haul. And Imperial certainly has a bigger vision for the mine than what is currently being installed. “Probably this time next year, we’re starting to look at a feasibility study on an expansion,” says Fisch, who explains that when Imperial acquired Red Chris in its 2007 purchase of bcMetals Corp., the application for the environmental assessment certificate had already been made. “The size of the orebody suggests that a 30,000 tonne-a-day plant isn’t adequate. There’s an awful lot of work to do.”

Indeed the copper Resource at Red Chris – 8.89 billion pounds of Measured and Indicated – is an order of magnitude larger than any of Imperial’s other projects. “We’ve never seen anything like this at Imperial before,” says Steve Robertson. He has been with the company for 21 years and was responsible for exploration of the Red Chris deposit. Now, as vice president of corporate affairs, Robertson says “this is the type of deposit that’s a company-maker. The current mine plan is only targeting a small part of that resource.” The major hurdle to expansion would be the additional waste rock, which would be too much for the current facility and require water management on a larger scale. All those interviewed seemed eager to begin the process of solving those problems, though, and confident an expansion will eventually happen.

“[Red Chris] gives us a different perspective on everything,” Robertson says. “We don’t spend money that we don’t have and that isn’t likely to change. We just have much greater means to live within now.”

Perhaps it is that comfort with the long-term viability of the project that keeps Imperial’s big investors happy. The most notable is N. Murray Edwards, who owns 36 per cent of Imperial’s common shares.

Robertson explains that Edwards’ involvement has shaped the character of the company. Earlier this year, Edwards’ Edco Capital Corporation arranged a $75 million junior unsecured loan to fund cost overruns and backstop payments for the Red Chris build. Edco gets a $750,000 fee and warrants to buy 750,000 shares at $20 each out of that deal. Imperial shares currently trade at around $16.

“He’s the reason why we are still around today,” Robertson says. “Having a strong, committed shareholder like Murray has prevented us from being a takeover target when we had great things happen, but he’s also been there during the bad times. It really has been an empire-building exercise.”

Fisch and his team are focused on the day-to-day tasks of building a mine, but he often mentioned the commitment of management and investors, and it is clear that despite the isolation, he does not feel cut off from Vancouver. “I like to tell people we interview [for jobs] not to be surprised if the president calls you up for this, that and the other thing,” Fisch chuckles. “We have a total of about 35 people in the head office. We started very small, and while we’ve grown in projects we haven’t necessarily grown in corporate size. There’s a lot of trust and a lot of communication between that small group. It’s just how we interact. It’s not a strictly top-down kind of organization.” Fisch has had three separate stints with the company, his current one beginning in 2004.

“It’s very much a family-oriented operation where many of us have been working together for a very long time,” Robertson adds. “We’re very intent on making a great mining company, and I don’t think there are a lot of people at Imperial that feel that flipping properties and selling out to a bigger venture for a lot of money would be a way to go. That’s not the vision that we hold.”