Fossil fuels currently make up a large majority of the world’s energy needs. But that is starting to change. And if the signatories to the 2015 Paris Agreement get serious, there will be winners and losers in commodities.

On the evening of Dec. 12, 2015, France’s Foreign Minister Laurent Fabius banged a green gavel and announced, “The Paris Agreement is adopted.” The 40,000 delegates at the 21st annual Conference of Parties (COP21) cheered the unprecedented accord: 196 nations agreed to a goal of keeping global average temperature increase less than 2° C above pre-industrial levels while striving for a 1.5° C-limit by 2100.

Countries had already proposed their respective contributions toward the marker, including Canada’s 30 per cent reduction in emissions from 2005 levels by 2030. Although targets are non-binding, signatories are required to assess progress towards meeting their climate commitments every five years, and submit new plans to bolster them.

The Paris Agreement speaks to a larger trend in modern society: an effort to mitigate climate change and its effects, from infrastructure-building to converting coal-fired generation plants and developing renewable energy sources. So which commodities will benefit from the shift in the new energy economy, and which will suffer?

Changing of the guard

To satisfy its energy needs, the world is currently heavily reliant on fossil fuels. According to the International Energy Agency’s (IEA) World Energy Outlook 2015, oil, gas and coal currently represent over 80 per cent of primary energy demand with oil at 31 per cent, coal at 29 per cent, and gas at 22 per cent of the mix. The report projects that fossil fuels will still dominate until 2040, where it will drop only slightly to 75 per cent.

In its February 2016 report, New Energy Futures, consulting firm PwC wrote that it also sees fossil fuels dwindling in the future, due to the Paris Agreement. “In the aftermath of COP21 and against a backdrop of heightened public concern about climate change, the long-term outlook for fossil fuels as a whole is to play a proportionally diminishing role in the world’s fuel mix,” it stated.

Stephen Schork, founder of the Schork Report, a commodities research firm, noted that North America has been witnessing the “ongoing death” of coal in recent years, as it is slowly phased out. In spite of major investments in supply, actual coal use has fallen, resulting in over-capacity and skidding prices. The IEA forecasts coal’s share of global electricity generation will fall from its current 41 per cent to 30 per cent by 2040, despite a tripling of coal demand in India and Southeast Asia.

According to Schork, natural gas will be the major beneficiary. “This has been the story for the past ten years,” he explained. Schork said he reckons natural gas will be more of a common fuel going forward rather than an interim fix to bridge the gap between a fossil fuel phase-out and a pure renewable-powered future, as was envisaged by many five years ago. “We’ve gotten so good about getting it out of the ground economically that the environmentalists don’t like it anymore,” he said, noting that renewables are not more commercially viable than gas in the near future. Natural gas’s contribution to the global energy mix is expected to climb two per cent per year until 2020, according to the IEA.

The IEA projects demand for oil will pick up until 2020, adding an average of 900,000 barrels per day (bpd) per year, but the subsequent rise to 103.5 million bpd in 2040 will be moderated by higher prices, efforts to phase out subsidies, efficiency policies and switching to alternative fuels. The share of non-fossil fuels is expected to expand from 19 per cent of the global mix today to 25 per cent in 2040. Nuclear and renewables are expected to grow the fastest.

Uranium

Cameco’s Cigar Lake, located in northern Saskatchewan, is the world’s largest undeveloped uranium deposit. Courtesy of Cameco Corporation

Nuclear power, currently generating 11 per cent of global electricity, relies on the mining and processing of uranium as a fuel.

Cameco Corporation, which produces about 18 per cent of the world’s uranium, expects to see around 113 new reactors built worldwide, more than 60 of which are already under construction, by 2025. Subtracting the 55 which are forecast to shut down, the end result will still be an 80-gigawatt (GW) growth in nuclear power over the next decade, with even more expected later, the company stated in its 2015 market overview.

Most growth is seen in countries with rapidly growing populations and economies. China leads the way with 24 reactors under construction. India, Russia, South Korea, the United Arab Emirates, and the United States are also building new reactors. And the UK has committed to nuclear energy as a source of emissions-free energy. Others with nuclear energy plants in the works are Turkey – with eight planned – Bangladesh, Vietnam, Jordan, Poland, Saudi Arabia, and Egypt. Today, the world’s reactors consume around 160 million pounds of uranium annually, states the Cameco report. “With the growth in reactor construction, we expect [consumption] to grow to around 220 million pounds per year by 2025, an average annual growth of three per cent.”

Because uranium production has outpaced consumption for several years, significant secondary supplies sit in stockpiles, meeting about 20 per cent of global needs. However, as stockpiles deplete, more primary production will be needed from mines – some, new mines. Cameco estimates about 10 per cent of supply over the next decade will need to come from mines not yet developed. This could cause supply difficulties as new mines require seven to ten years’ lead time to produce.

Cameco’s forecast was prepared just prior to the 2015 Paris Agreement. “Some of the language that we heard coming out of the Paris Climate Conference was encouraging,” said Cameco president and CEO Tim Gitzel. “While we certainly agree that nuclear power is an important tool for combatting climate change, we have not changed our forecast based on the agreement.”

Despite all the meticulous forecasting, there is an unpredictable side to uranium demand: politics. “We have seen what happened in Germany [which replaced previously committed nuclear power with renewables following the Fukushima incident] but I think what we’ve seen in Japan is even more telling,” said Schork. “In the wake of Fukushima, the assumption was that Japan was going to completely wean itself off nukes.” But Japan did not; instead it has decided to maintain its nuclear growth. “From a [power] generation standpoint [nuclear is] beautiful,” said Schork. “It produces copious amounts of relatively cheap fuel and it is environmentally friendly, except what to do with the spent fuel.” But with the current abundance of cheap natural gas, “to build a new reactor you’re not going to get your costs back. I think it’s a matter of market economics.”

Renewables

Renewable energy sources, including solar panels and wind turbines, are also set to start playing a bigger role in the global energy mix. Despite cheap oil prices, investment in clean energy technology continued to grow in 2015. A Bloomberg report noted a four per cent increase from 2014 to US$329 billion.

According to the 2016 edition of BP’s Energy Outlook, renewables are expected to grow at around 6.6 per cent per year, their share of the global energy mix tripling from three per cent today to nine per cent by 2035. “Renewables account for over a third of the growth in power generation, causing their share of global power [generation] to increase to 16 per cent by 2035,” said BP chief economist Spencer Dale. “The world is starting to make the transition to a lower-carbon energy system, and the COP21 meeting in Paris last December represented a significant step on this journey.”

The Solar Energy Industries Association is encouraged by the recent accord. “I think the Paris Agreement will provide the impetus for greater adoption of renewables around the world,” said Dan Whitten, vice-president of communications. “It isn’t going to all happen overnight, but the Paris Agreement definitely will help advance renewables both in the United States and abroad. It was a promising sign that just days after 196 nations agreed on the Paris Accord, the U.S. approved significant extensions of renewable energy tax credits.”

Supply of the main commodities used to manufacture today’s solar panels – polycrystalline silicon, silver and copper – is expected to meet demand. According to Bloomberg, the supply of polycrystalline silicon will exceed needs of the 66 GW world total expected by 2017. The use of silver in photovoltaic technology – used to convert sunlight into energy – is currently six per cent of world demand, and the Silver Institute predicts a slight decline in world silver production over the next few years partly due to its associated production with price-challenged commodities like copper and zinc.

In February, a team of American researchers announced it had made an efficiency breakthrough for cadmium telluride (CdTe) solar cells. The upside is that the cells are a lower cost alternative to the silicon cells that dominate the solar market. As significant as the technical achievement may be, however, access to the necessary raw materials will likely determine the future of the technology. An MIT study from 2014, looked back in history at the ability of various commodity producers to respond to increased demand. The results revealed that potentially “game-changing” technologies such as high-efficiency CdTe cells would quickly run into supply problems if their adoption began scaling up. Silicon cells and the materials they require, on the other hand, would not hit the same ceiling.

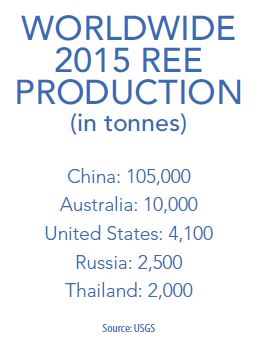

The Global Wind Energy Council projects wind turbine capacity to grow from 432 GW at the end of 2015 to 666 GW by 2019. Critical commodities in wind turbine manufacturing are the rare earth elements (REEs) used in magnets; most notably neodymium for which supply is estimated at 21,000 tonnes per year, 91 per cent of which originates in China. For a time, China restricted the supply of rare earth materials through export quotas. But in 2014, the World Trade Organization ruled against the quotas and China scrapped them in December of that year. According to the US Geological Survey (USGS), neodymium supply and demand is expected to increase rapidly over the coming decade, at around seven per cent per year. Supply is expected to keep up with demand, although the market balance will remain reasonably tight.

Lithium

“I think all these agreements are good for the world – they basically affirm what [society] has been thinking, that we need to change our ways,” said Edward Anderson, president and CEO of TRU Group Inc. and a global lithium analyst.

About 50 per cent of lithium consumption goes into traditional uses like glass and ceramics. The room for growth, Anderson reckons, is driven by the other 50 per cent – what he calls lithium chemicals like lithium carbonate – mainly for batteries and metal alloys used in aerospace and military applications. The need for lithium-ion batteries will forge ahead with the expected growth in popularity of electric vehicles (EVs). “I think lithium chemicals are ready for substantial growth – 10 to 15 per cent,” he said. “EV growth could be 20 per cent.”

But for grid storage, the other potentially major use of lithium-ion batteries, demand will be more tempered, said Anderson. “For EVs, there’s really no alternative,” he explained. “They’re light, efficient and adaptable to EV requirements. For storage you don’t have the same requirement; cheaper lead-acid batteries can be used.”

Lithium supply will be able to keep up, he said. “You have the big lithium guys, like SQM (Sociedad Quimica y Minera de Chile) and Albemarle. They control the market and always will.” Mining start-ups, he said, will face higher costs, probably double the cost of expanding an existing plant. “We’ve had examples of that – RB Energy built a new plant in Quebec but it closed in 2013 because it was not competitive.” The big mines, he said, will be able to meet demand expected in the next five to ten years, if they decide to expand current operations. If not, “new ones like Orocobre Limited (an Australia-based exploration company) could provide swing capacity,” said Anderson. “So absolutely there is no issue with supply of lithium.”

Non-fossil fuels are expected to increase their contribution to the world energy mix to 25 per cent in 2040 from 19 per cent today. Courtesy of Borrego Solar

Non-fossil fuels are expected to increase their contribution to the world energy mix to 25 per cent in 2040 from 19 per cent today. Courtesy of Borrego Solar

Graphite

Graphite is another important constituent of lithium-ion batteries. “In a lithium-ion battery, it is about five per cent lithium and 50 per cent graphite, so in reality it should have been called graphite-ion,” quipped Paul Gorman, CEO of Toronto-based Great Lakes Graphite. Lithium-ion batteries currently consume just a sliver – around seven per cent – of the world’s graphite market.

Gorman, who has spent the last seven years working in the graphite space, expects this number to climb. “I would say high-purity graphite over the next five to seven years is going to be predominantly used for EVs and for grid storage,” he said.

However forecasts have been tempered. “EVs have not been selling as well in North America as expected over the last couple of years with the price of gasoline at less than two dollars a gallon,” said Gorman. But he said he figures demand for these products will dramatically improve over time. “If you go by the projections that Tesla has out there right now, the total requirement for graphite for EVs is about 80,000-100,000 tonnes per year. Once their Nevada-based Gigafactory is on line, you’re looking at exponential growth in graphite use and production.”

In the near term, current producing mines around the globe should be able to provide the supply requirements, Gorman said. But there are other restrictions in the supply chain that could impact production. “It’s more than mining the graphite as a commodity,” he said. “The bottlenecks come in micronizing it, purifying it, shaping it and coating the graphite particles.” Since most of the graphite production today comes from China, he said it could be difficult for any North American supplier that has not already got a producing mine to stay ahead of the curve.

So overall will there be an explosion in demand for battery graphite in the near term? For grid storage, “I think there is enough global supply to meet that demand,” said Gorman. “The real issue is going to be when the EV market really catches fire globally. From all indications and slumping oil prices, I think that is going to be a while.”

Paul Ferguson, chief marketing officer at Great Lakes Graphite, said nobody really knows the market yet, “because some of these products like Tesla’s Powerwall have only just started shipping, so we don’t know how it is going to do. A lot of the grid storage players are still in development mode so we haven’t seen the full impact of that either. Whether high demand actually materializes remains to be seen.”

Opportunity vs. reality

Of course, there is always the possibility that much of the foregoing enthusiasm and optimism generated by Paris 2015 could fade depending on the economy. If jobs are on the line in recessionary times, said Schork, “[Governments] won’t sacrifice the economy to save half a degree on temperature.”

Already, in early February, the U.S. Supreme Court delivered a major blow to President Barack Obama’s Clean Power Plan by putting on hold federal regulations to curb CO2 emissions mainly from coal-fired power plants. The court voted 5-4 to grant a request by 27 states – mostly those relying on fossil fuel production for healthy economies – and various companies and business groups to block the plan, which mandates a shift to renewable energy away from fossil fuels.

Consumer-calculated economics enters the picture too. Low prices at the pump are cutting into the EV and hybrid advantage. Sales of plug-ins are down by around six per cent in the U.S. and in Canada sales of hybrids have reportedly plummeted by about 32 per cent since their 2012 peak. With gasoline well under a dollar per litre in most of North America, consumers are less willing to pay an $8,000 or $10,000 premium. Tesla Motors’ stock fell nine per cent in early February on reduced EV sales expectations. Moreover, the existence of low gas prices provides less incentive for companies and governments to implement reduced mileage targets.

On the other hand, such responses only work up to a point. China’s breakneck industrialization came at the expense of the environment, and now it has become a critical social, political and economic issue for the country. But is climate change as visible as China’s smoke-darkened skies? As most organizations acknowledge, the Paris Agreement is a highly encouraging step – and the good news is that world commodities are there to build the solutions.

More Operations

All packed and ready to go

Proven benefits and outside financial pressure push modular construction into the mining mainstream

Steelmaking coal price surge reinvigorates Canadian mines

Conuma Coal Resources plans to reopen three coal mines in eastern B.C.